IAN Group's Investment Philosophy

Invest and breed innovative startups solving real-world problems, driven by technology, targeting a large market led by founders focused on execution and excellence. IAN Group’s investment strategy is built on risk mitigated high return strategy, driven by leveraging the Group’s mentor and expert pool and global networks.

Portfolio Highlights

19+ years of Early Stage Investing in India,

creating a lasting impact

~ 1050Cr (INR) invested

250+Startups Backed

20000Cr (INR) Catalysed

19+Years of Operation

Latest Insights

IAN Angel Fund Backs LearnTube in Seed Round, Strengthening Its Focus on Future-Ready Skills

New Delhi, 13th January’26: IAN Group, the country’s single largest early-stage investment platform, has invested, through the IAN Angel Fund,…

Trishul Space Raises ₹4 Crore in Pre-Seed Funding Round led by IAN Angel Fund

New Delhi, November 10, 2025 — Trishul Space, an advanced rocket propulsion startup developing next-generation liquid rocket engines, has secured…

AI startup Uniphore raises $260 million in Series F from Nvidia, AMD, Snowflake, Databricks

Artificial intelligence (AI) for business platform Uniphore has raised $260 million in a Series F round from global tech majors…

Morphing Machines Series A Funding Led by IAN Alpha Fund

Morphing Machines, a Bengaluru-based fabless semiconductor IP company at the Indian Institute of Science (IISc), has raised ₹38.36 crore in a Series…

IAN Alpha Fund invests in EndureAir Systems with ₹25 crores

New Delhi, 10th Sep 2025: EndureAir Systems, a deep-tech UAV (Unmanned Aerial Vehicles) company & aerial robotic solutions provider, has…

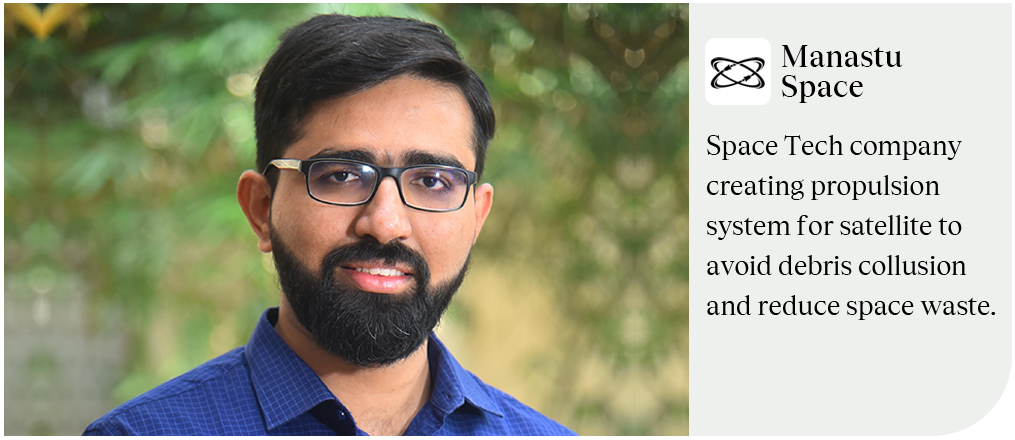

Startup Founders Speak

To invest in IAN Angel Fund

Write to us on : smriti@iangroup.vc

To invest in IAN Alpha Fund

Write to us on : sanat@iangroup.vc

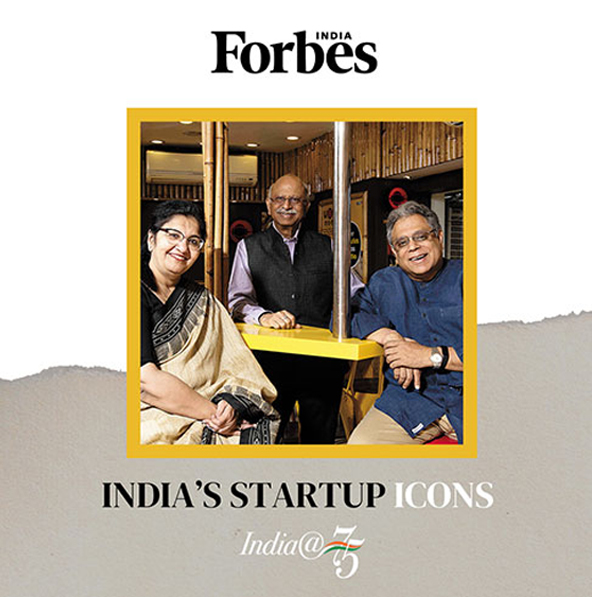

India@75: IAN's Group inception Featured as an Iconic Event of Independent India

On Independence Day, Forbes India released an exhaustive timeline of iconic moments and milestone events over 75 years and IAN Group (2006) found a place in a list that includes the launch of institutions like RBI, LIC, Reliance, IIM, IDBI , HCL, Infosys, NASSCOM, Naukri, Flipkart etc. which contributed to the economic rise of our country.

Read MoreIAN Capital | Category I- Venture Capital Fund (Angel Fund) | SEBI Registration No. – IN/AIF1/20-21/0862 | Investment Manager – Indian Angel Network Services Pvt Ltd