IAN Group's Investment Philosophy

Invest and breed innovative startups solving real-world problems, driven by technology, targeting a large market led by founders focused on execution and excellence. IAN Group’s investment strategy is built on risk mitigated high return strategy, driven by leveraging the Group’s mentor and expert pool and global networks.

Portfolio Highlights

19+ years of Early Stage Investing in India,

creating a lasting impact

~ 1050Cr (INR) invested

250+Startups Backed

20000Cr (INR) Catalysed

19+Years of Operation

Latest Insights

IAN Alpha Fund Co-Leads ₹70 Cr Series A Funding Round in Peptris

New Delhi, 18 Feb ’26: IAN Alpha Fund, the 2nd in the series of IAN Group’s VC funds, along with…

IAN Group leads ₹27.4 Cr seed round in e-TRNL Energy to back next-gen battery cell innovation

New Delhi, 13th February 2026: IAN Group, the country’s single largest early-stage investment platform, has led a ₹27.4 crore seed…

IAN Alpha Fund Invests ₹25 Crore in D-Propulse Aerospace

New Delhi, 28th Jan’26: IAN Alpha Fund, the 2nd in the series of IAN Group’s VC fund, has invested ₹25…

IAN Group backs Chargeup in INR 22 Crore Funding Round

New Delhi, 22nd January 2026: IAN Group, the country’s single largest early-stage investment platform, has invested in Chargeup’s ₹22 crore…

IAN Angel Fund Backs LearnTube in Seed Round, Strengthening Its Focus on Future-Ready Skills

New Delhi, 13th January’26: IAN Group, the country’s single largest early-stage investment platform, has invested, through the IAN Angel Fund,…

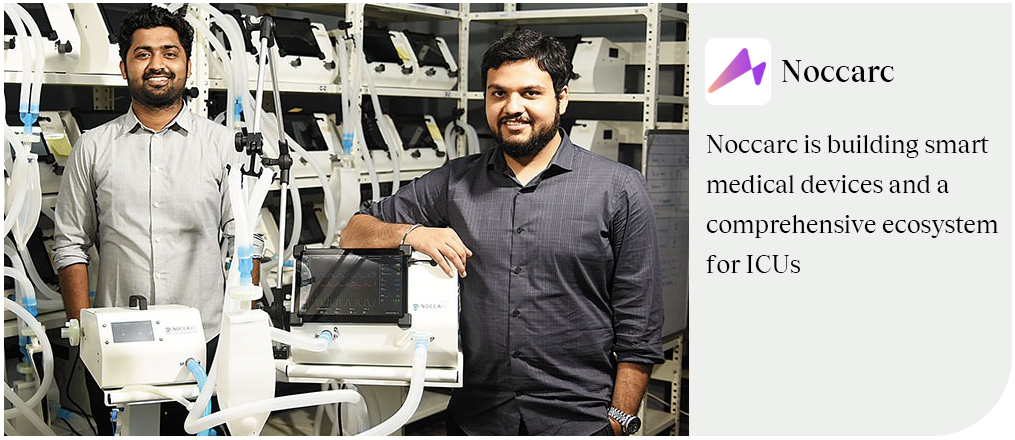

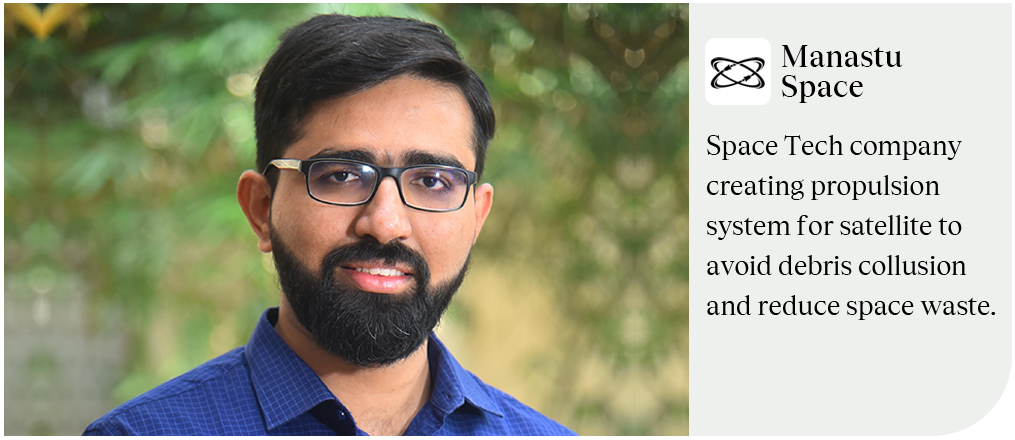

Startup Founders Speak

To invest in IAN Angel Fund

Write to us on : smriti@iangroup.vc

To invest in IAN Alpha Fund

Write to us on : sanat@iangroup.vc

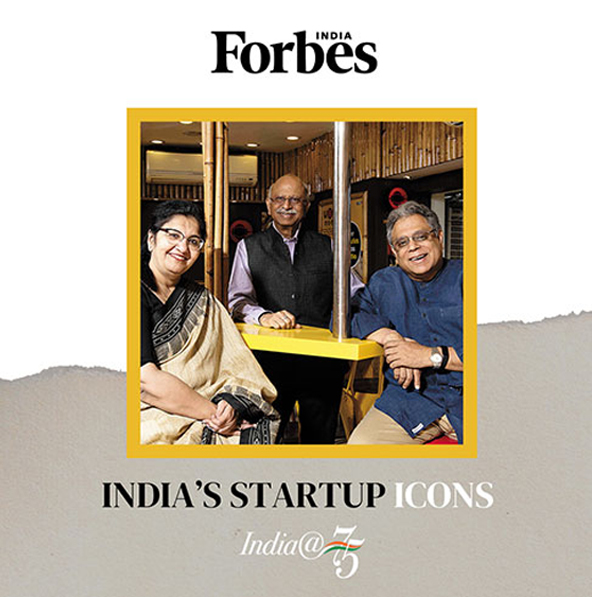

India@75: IAN's Group inception Featured as an Iconic Event of Independent India

On Independence Day, Forbes India released an exhaustive timeline of iconic moments and milestone events over 75 years and IAN Group (2006) found a place in a list that includes the launch of institutions like RBI, LIC, Reliance, IIM, IDBI , HCL, Infosys, NASSCOM, Naukri, Flipkart etc. which contributed to the economic rise of our country.

Read MoreIAN Capital | Category I- Venture Capital Fund (Angel Fund) | SEBI Registration No. – IN/AIF1/20-21/0862 | Investment Manager – Indian Angel Network Services Pvt Ltd